In Italy there is a consolidated tradition of support for culture and art by private individuals, which has not failed even during the years of crisis caused by the Covid 19 pandemic.

The most important items characterising the system of private donations, regularly recorded and for which exhaustive information is available, are illustrated below. In particular, strong support is provided by Banking Foundations and donations, in various forms, which are formally registered by the Ministry of Culture or by subjects linked to it.

Banking Foundations

The important subsidiary role played by Banking Foundations in the field of art, cultural assets and activities is confirmed with respect to public investments, although it is still unevenly distributed across the territory.

The XXVI Annual Report on Banking Foundations drawn up by ACRI (Associazione di Fondazioni e Casse di Risparmio s.p.a) in the year 2020 lists 86 Foundations of banking origin[1]. These Foundations operate for purposes of social utility and promotion of the economic development of the territory within the scope of 13 sectors of intervention, according to their strategic orientation, including the cultural sector; to these an additional item has been added to the Fund for combating juvenile educational poverty.

Most of the Foundations are located in the regions of Northern and Central Italy (76 Foundations out of a total of 86). Considering the strong link between these institutions and their territories and communities, the majority of grants fall in these areas, highlighting a significant territorial imbalance that is addressed through a series of initiatives and projects dedicated to the South. In particular, mention should be made of the initiatives promoted by Fondazione con il Sud, a private non-profit organisation set up in 2006 as a result of an alliance between foundations of banking origin and the third sector and the voluntary sector. One of the objectives of Fondazione con il Sud is to support the protection and enhancement of common assets (historical, artistic and cultural heritage, environment, social reuse of assets confiscated from the mafia).

Total disbursements in 2020 amounted to €949.9 million, an increase of 4.3% compared to 2019; the Arts, Activities and Cultural Heritage sector is once again in first place (23.2%), followed by Volunteering, Philanthropy and Charity (15.3%) and Research and Development (11.9%). However, the first and third sectors show a decrease in percentage terms compared to 2019, respectively -8.4% and -13.6 compared to the considerable increase in disbursements in the Public Health sector due to the support provided to cope with the spread of Covid-19.

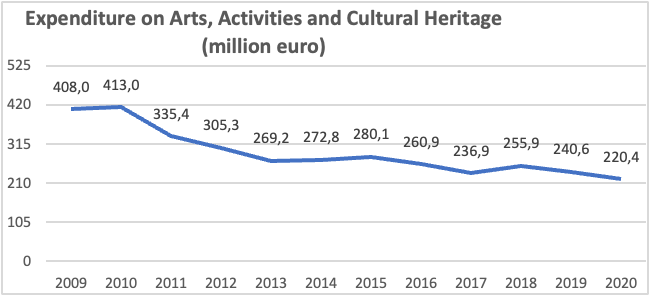

Expenditure by Banking Foundations on Arts, Activities and Cultural Heritage – 2009-2020 (million euro)

From 2010 to 2020, the banking foundations’ support for the sector fell by 47%, from €413 million in 2010 to €220 million in 2020, against a 30% reduction in the overall support provided for all missions by the foundations.

In recent years – and even more so in 2020, when the sector has been hard hit by the crisis – the Foundations’ strategic choices in the cultural sphere have focused on implementing measures aimed at improving management, building local partnerships and networks, and strengthening entrepreneurship, especially among young people. The Foundations’ support aimed at starting up creative, artistic and musical activities and, to a lesser extent, at restoring the historical and architectural heritage.

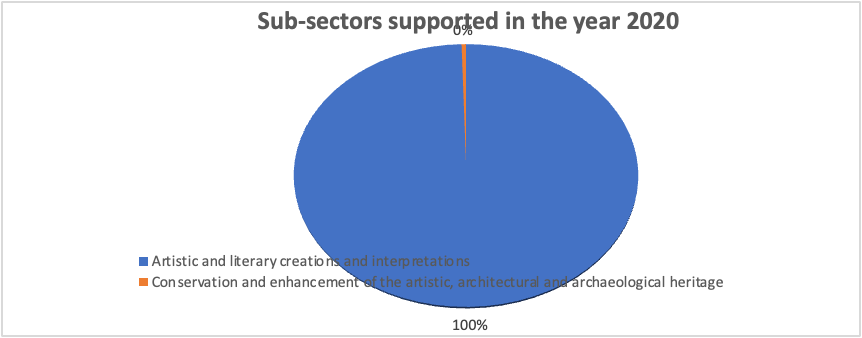

In 2020, the main beneficiaries of grants in the Arts, Activities and Cultural Heritage sector were “Foundations” (43%), followed by “Other private associations” (18.8%), “Local authorities” (12.3%), “Other private entities” (10.9%) and “Religious and cult organisations” (7.1%). In the same year, just under 60% of the resources were allocated to support projects relating to artistic and literary creation and interpretation and the conservation of cultural heritage.

Sub-sectors supported by Bank Foundations -2020

Art Bonus

Decree Law No. 83/2014 introduced an important measure, the so-called Art Bonus, aimed at encouraging private participation in supporting the public cultural heritage. The Art Bonus was initially a temporary measure, later made permanent by the 2016 Stability Law, no. 208 of 2015. The facility in the form of a tax credit favours liberal donations in support of culture and entertainment. The donor can enjoy a favourable tax regime in the form of a tax credit equal to 65% of the disbursements made and within the limits of 15 per cent of taxable income, in the case of individuals and non-commercial entities; while, in the case of persons with business income, to the extent of 5 per thousand of annual revenues.

As a result of a series of successive provisions aimed at refining the application of the measure, the tax credit is now available for donations made in cash and for the following purposes:

- Maintenance, protection and restoration of public cultural assets.

- Support for public cultural institutes and venues, opera and symphony foundations, traditional theatres, concert and orchestra institutions, national theatres, theatres of major cultural interest, festivals, theatre and dance production companies and centres, as well as distribution circuits, instrumental ensembles, concert and choral societies, circuses and travelling shows.

- Construction of new structures, restoration and enhancement of existing ones of public bodies or institutions that, without any profit-making purpose, carry out exclusively activities in the performing arts.

Art bonus – Donations and Patrons, 2016-2021 (million euro)

| 2016* | 2017* | 2018** | 2019* | 2020* | 2021*** | |

| Donations | 138,17 | 226,79 | 264,77 | 417,51 | 546,67 | 615,45 |

| Patrons (n.) | 4.594 | 7.458 | 10.687 | 14.902 | 21.226 | 25.121 |

| Beneficiary bodies (n.) | 2.158 | |||||

| target assets (n.) | 2.787 |

* Cumulative values as at 31/12; ** Cumulative values as at 31/07; *** Cumulative values as at 30/11/2021

At the end of November 2021, over 25,000 patrons and relate to 2787 properties donate €615.5 million since the launch of the facility in 2014. On that ammount, 63.0% of the donations have been earmarked for maintenance, protection and restoration work (group a.), 35% for the support of public cultural institutes and venues, lyrical-symphonic foundations, traditional theatres, etc. (group b.), 2% for the support of public cultural institutes and venues (group c.), 2% in favour of projects for the realisation, restoration and enhancement of structures of public performing arts bodies and institutions (group d.).

The beneficiary bodies, totalling 2,158, are mainly municipalities (51%), followed by concessionaires of cultural and public assets (14%) and, at a considerable distance, companies and theatre production centres (6%).

About 78% of the donations come from northern regions, 17% from central regions and only 6% from southern regions. The geographical imbalances are slightly reduced if we look at the location of the goods/interventions supported, 51% of which are distributed in the North, 37% in the Centre and 12% in the South.

In 2019, the highest fundraising was recorded in 2020, while in 2021 there was a sharp decrease of almost 50%, reasonably attributable to the crisis.

Donations by private individuals and corporations

Further tax benefits are available to individuals or legal entities in terms of income-deductible expenses (companies) or income-tax-deductible expenses (individuals and non-commercial entities) that make donations to the public sector or the private non-profit sector for the support of cultural goods and activities (Article 100, paragraph 2, letter m) and Article 15, paragraph 1, letter h) of Presidential Decree no. 917/1986 (see chapter 4.1.4).

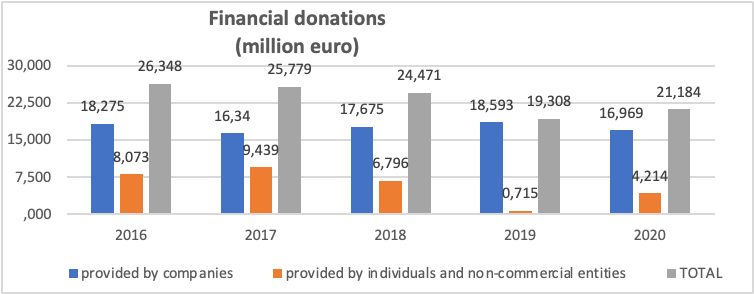

The Ministry of Culture takes care of the fulfillment of the obligations relating to the tax benefits and every year it issues a decree recording the donations received by the beneficiary entities and notifying the Revenue Agency of the list of the names of the donors and the related disbursements. Donations have been decreasing over the years, as can be seen from the summary tables in the Ministry’s circulars, and in 2020 they amounted to approximately €21 million for both components of the benefits provided (businesses – individuals and non-commercial entities), with a decrease of almost 60% compared to 2007 and of approximately 10% compared to 2019.

Financial donations made to State, Regions, local territorial bodies, public bodies or institutions, legally recognized Foundations and Associations

| Provided by companies | Provided by individuals and non-commercial entities | TOTAL | Var. 2016-2019 (%) | |

| 2016 | 18,27 | 8,07 | 26,35 | |

| 2017 | 16,34 | 9,44 | 25,78 | |

| 2018 | 17,68 | 6,80 | 24,47 | |

| 2019 | 18,59 | 0,71 | 19,31 | |

| 2020 | 16,97 | 4,21 | 21,18 | -19,6% |

Financial donations made to State, Regions, local territorial bodies, public bodies or institutions, legally recognized Foundations and Associations

Over the years, Southern Regions have received a very limited share of the donations collected, giving priority to the regions of the North and then the Centre, with the gap between these two categories narrowing over the years. In 2020, the regions of Lombardy, Tuscany and Lazio alone accounted for 75% of donations collected.

As far as the purpose of donations is concerned, patronage in the cultural sector is generally higher than in the entertainment sector.

5 x 1000

Since 2012 the institution of the 5 x 1000, born in 2006 for social purposes, has been extended to the cultural sector. The rule provides that the taxpayer can allocate the share of 5 per thousand of the personal income tax to finance the activities of protection, promotion and enhancement of cultural and landscape heritage (paragraph 46 of Article 23 of Law No 111 of 15 July 2011). In particular, the measure favours: a) The Ministry of Culture. b) The institutes of the same Ministry endowed with special autonomy. c) Non-profit organisations, legally recognised, which carry out, in accordance with their main purposes defined by law or by statute, activities of protection, promotion or enhancement of the cultural and landscape heritage and which can demonstrate that they have been operating in this field for at least 5 years. The Ministry of Culture takes care of the related tasks, drawing up the list of those eligible and disbursing the sums due. Through this measure, allocations have been made to the beneficiary entities from 2015 to 2018 for an amount of just under 10.5 million euros.

Funding from lotteries

Since 1996, a portion of the proceeds from the lottery draws, allocated to the budget of the Ministry of Culture, has been earmarked for the protection and enhancement of cultural heritage. Significant resources were allocated in the early years to investments in the cultural sector (154 million in 2016 and the same amount in 2017), but the flow gradually decreased to 22.5 million euros in 2014. From this year, the resources, considering the smallness of the sums available and the need to limit their excessive dispersion, have been aimed exclusively at covering the costs of the services and activities carried out by Ales spa, an in-house company of the Ministry of Culture, engaged in support activities for the conservation and enhancement of the cultural heritage and in support of activities for the technical and administrative offices of the administration. The 2021 Budget Law confirmed this measure by providing, from the proceeds of the lottery game, an allocation of €23 million for 2021 and €33 million for each of the years from 2022 to 2035.

[1] https://www.acri.it/

Comments are closed.