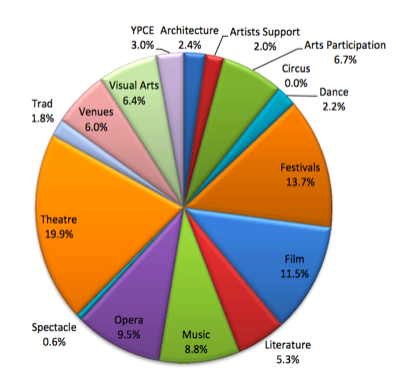

The total private investment in culture in 2014 was EUR 8,919,000. That same year, sponsorship of the arts was EUR 3.6 million and voluntary income stood at EUR 5.3 million.[1] Theatre, festivals and film receive the largest private investments respectively, closely followed by opera and music. Generally, there is a trend of increased private investment but it is still very low.

Total private investment received by sub domain (2014)

Source:

Private Investment Report 2016, Arts Council

The 2016 Arts Council report on private investment in the arts[2] also captured the impact variants of private funding according to location in Ireland. The report clearly points out that private investment is highly centralized around the nation’s capital: 65% of total private investment went to the province of Leinster and 52% to Dublin County. Outside of the capital, there is also a clear bias towards urban investment: around 77% of total private investment in the arts nationally goes towards four counties with larger urban centres.

The Arts Council has encouraged arts organisations to diversify their income and become proportionally less reliant on the Arts Council. In 2020, the Council launched phase two of its three phase programme called RAISE. The programme aims at building capacity to generate significant new private investment by delivering the skills and resources to build robust, sustainable philanthropic and private investments. This initiative has had some success with higher profile organisations.

Business to Arts (BtoA) is a membership-based, charitable organisation that brokers, enables and supports creative partnerships between businesses, individuals and the arts. The business members are teamed up with arts organisations and artists to develop solutions in areas such as sponsorship, commissioning, brand development, training, leadership development, internal and external communications, and events. BtoA also runs a crowdfunding platform called Fund it. This allows individuals and companies around the globe to support creative projects from Ireland. In the financial year 2018/19, over 4,165 pledges from funders has resulted in over EUR 248,387 paid to over 52 creative projects across Ireland. The BtoA Arts Fund project is Ireland’s first arts fund supported by companies, organisations and individuals. The Arts Fund has enabled over EUR 375,669 of investment in arts education projects, bursaries and prizes for artists and commissions of new artworks.

In 2018, over EUR 13 million was spent by corporate sponsors on arts, festivals and music sponsorship according to BtoA. Fundraised income for the not-for-profit sector is increasing exponentially each year. But it is still only 8% of the total income of the not-for-profit sector according to the 2into3 Irish Not-for-Profit Sector: Fundraising Performance Report 2019. Transparency is decreasing within the sector with more organisations submitting abridged accounts. State and earned income represent the largest proportion of income across the not for profit sector. This is no different for the Arts, Culture and Media category: State income averages 56% and earned income is 29%; Fundraising is 12% and sponsorship is 1%.

With the majority of arts and cultural organisations operating low staff numbers, fundraising is often sidelined until a later date. However, staffing levels across the whole not-for-profit sector are also low. The total fundraised income for the Irish not-for-profit sector was EUR 1.1billion in 2017, but per capita giving in Ireland lags behind the UK and US.

There are over 20,000 not-for-profit organisations in Ireland. The category Arts, Culture and Media represent 5% of the total sector but only receive 3% of income of the total not-for-profit sector. The fundraised income for Arts, Culture and Media was down almost 12% in 2018 from the previous year.

When comparing Irish giving to the UK and US, the stand out area for growth is foundations. In the UK the percentage of fundraised income from foundations is the same as the US at 16%. Yet this figure is only 1% in Ireland. Ireland’s treatment of charitable giving is preventing the development of this income stream. The lack of tax benefit available on individual donations is seen as a barrier in Ireland. Also the high minimum donation of EUR 250 in Ireland means many donations do not meet the required threshold for tax benefit.

The not-for-profit sector comes under the regulation of the Charities Regulator, which became operational in 2014. Under the Charities Act (2009) it was intended that a Statement of Recommended Practice (SORP) would become mandatory. This hasn’t happened yet, but it is expected under the Act that organisations with a charitable status adhere to the Guidelines for Charitable Organisations on Fundraising from the Public and the Governance Code for the Community and Voluntary Sector.[3]

[1] 2into3 (2016) Irish Arts Sector: Private Investment Report.

[2] Ibid.

[3] 2into3 (2019) The Irish Not-for-Profit Sector: Fundraising Performance Report.

Comments are closed.